Palladium

Palladium Network: Building a More Stable and Adaptive Investment Ecosystem

Introduction

In a constantly changing global financial landscape, the ability to balance stability with adaptability is crucial for long-term investment success. The Palladium Network has emerged as an innovative platform that embodies these principles, offering an investment ecosystem designed to deliver both stability and adaptability. This article explores how the Palladium Network is building a more stable and adaptable investment ecosystem, highlighting its features, benefits, and potential impact.

How Palladium Compares to Other Projects

Many blockchain projects claim to integrate real assets or offer stable returns—but how does Palladium measure up?

- 1. Versus Stablecoins

- Stablecoins (like USDT or USDC) are pegged to fiat currency, offering stability but no growth potential. Palladium, by contrast, combines stability with profit-sharing, giving investors a way to grow wealth rather than simply preserving it.

- 2. Versus Traditional REITs

- Real Estate Investment Trusts (REITs) allow fractional ownership of property, but they are centralized, heavily regulated, and often limited to accredited investors. Palladium's NFT-based model democratizes access globally while ensuring blockchain-level transparency.

- 3. Versus DeFi Yield Farming

- Yield farming offers high returns but comes with extreme volatility and permanent loss risks. Palladium reduces exposure by anchoring rewards to real estate and arbitrage trading profits—both of which are more sustainable.

The Importance of Stability and Adaptability in Investment

Stability is crucial in investing because it provides investors with a sense of security and certainty. Stable assets tend to maintain their value over time, protecting investors from significant losses. Adaptability, on the other hand, is crucial for navigating changing market conditions and capitalizing on new opportunities. Adaptable investment platforms can adjust their strategies and offerings to remain relevant and competitive.

Palladium Network: Balancing Stability and Adaptability

The Palladium Network is designed to balance stability and adaptability through a unique combination of features and mechanisms:

- Asset Diversification: The Palladium Network supports a wide range of assets, including traditional assets like real estate and commodities, as well as digital assets like cryptocurrencies and tokens. This diversification helps stabilize the platform and mitigate risk.

- Investment Strategies: The Palladium Network offers a variety of investment strategies, ranging from conservative to aggressive approaches. This flexibility allows investors to choose a strategy that best suits their risk tolerance and investment objectives.

- Technology: The Palladium Network utilizes cutting-edge technologies, such as blockchain and artificial intelligence, to enhance stability and adaptability. Blockchain technology provides security and transparency, while artificial intelligence enables the platform to analyze market data and make informed investment decisions.

- Decentralized Governance: The Palladium Network has a decentralized governance system that allows token holders to participate in decision-making. This governance ensures that the platform is responsive to the needs of its community and can adapt to changing market conditions.

Building Stability in the Palladium Network Ecosystem

The Palladium Network builds stability through several key mechanisms:

- Asset Diversification: By supporting a wide range of assets, the Palladium Network reduces the risks associated with a single asset.

- Risk Management: Palladium Network uses advanced risk management techniques to protect investors from losses.

- Transparency: The Palladium Network provides full transparency into its operations and finances, building trust and confidence among investors.

- Compliance: The Palladium Network complies with all applicable regulations, ensuring that the platform operates in a legal and ethical manner.

Building Adaptability in the Palladium Network Ecosystem

The Palladium Network builds adaptation through several key mechanisms:

- Innovation: The Palladium Network continues to innovate and develop new products and services to meet the changing needs of investors.

- Flexibility: The Palladium Network is flexible and can adapt to changing market conditions.

- Feedback: Palladium Network seeks feedback from its community and uses this feedback to improve the platform.

- Partnerships: The Palladium Network partners with other companies and organizations to expand its reach and offer new services to investors.

- Decentralized Governance: The decentralized governance system allows the Palladium Network to respond quickly and effectively to changing market conditions.

Benefits of a More Stable and Adaptive Investment Ecosystem

A more stable and adaptive investment ecosystem offers a number of benefits to investors on the Palladium Network:

- Higher Returns: The Palladium Network has the potential to generate higher returns than traditional investment platforms.

- Risk Reduction: The Palladium Network reduces the risks associated with investing.

- Flexibility: The Palladium Network offers greater flexibility and control over investments.

- Transparency: The Palladium Network provides transparency and accountability.

- Accessibility: The Palladium Network is accessible to investors of all experience levels.

Potential Impact of the Palladium Network

The Palladium Network has the potential to significantly impact the investment ecosystem:

- Democratization: The Palladium Network democratizes investment by making it more accessible and affordable for everyone.

- Innovation: The Palladium Network drives innovation in the investment industry.

- Transparency: The Palladium Network increases transparency and accountability in the investment industry.

- Efficiency: The Palladium Network increases efficiency in the investment industry.

Challenges and Risks

While the Palladium Network offers many benefits, it is important to acknowledge the challenges and risks associated with this platform:

- Regulation: The regulatory landscape for digital assets is still evolving.

- Security: Digital assets are vulnerable to hacking and other cyber attacks.

- Volatility: Digital assets can be highly volatile.

- Complexity: The Palladium network can be complex and difficult to understand.

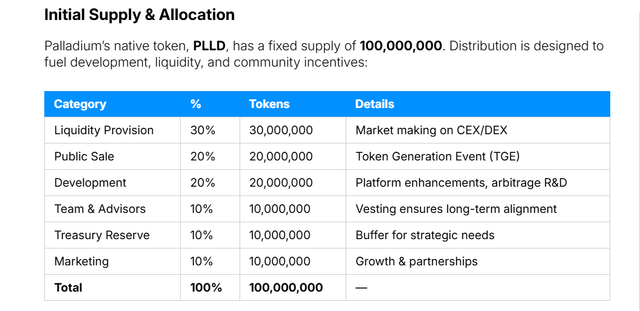

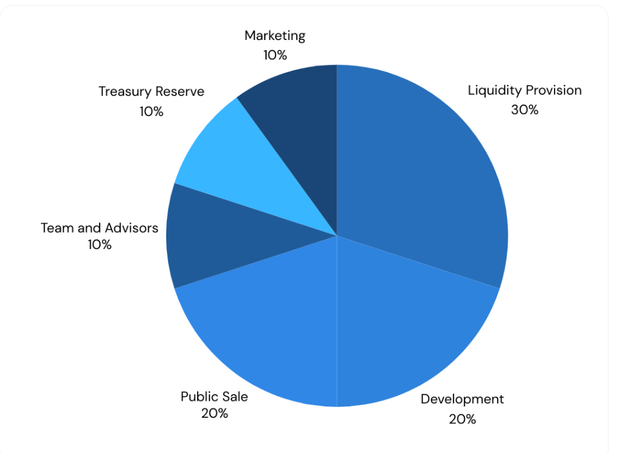

Tokenomics

Palladium's native token, PLLD, has a fixed supply of 100,000,000. Distribution is designed to fuel development, liquidity, and community incentives:

- Liquidity Provision - 30%- 30,000,000- Market making on CEX/DEX

- Public Sale - 20%- 20,000,000- Token Generation Event (TGE)

- Development - 20%- 20,000,000- Platform enhancements, arbitrage R&D

- Team & Advisors - 10%- 10,000,000- Vesting ensures long-term alignment

- Treasury Reserve - 10%- 10,000,000- Buffer for strategic needs

- Marketing - 10%- 10,000,000- Growth & partnerships

Screenshot_5.png

Vesting Schedules

Development (20%)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (eg, Swap launch, real estate tokenization).

Team & Advisors (10%)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

Treasury Reserve (10%)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

Marketing (10%)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

Screenshot_1.png

Buyback Mechanism

Central to Palladium's sustainability is a profit-sharing buyback system, where a portion of PLLD's arbitrage returns fund repurchases:

- Arbitrage Earnings: Profits generated from market inefficiencies are channeled into the buyback pool.

- Periodic Token Buys: At random intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

- Supply Reduction: Tokens are transferred to the treasury or retired, potentially effectively shrinking circulating supply and supporting the token's market value.

Transparent Reporting" Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

PLLD Token Utility: More Than Just a Crypto

The PLLD token is central to Palladium's ecosystem, serving multiple purposes:

- Arbitrage-driven buybacks → A portion of profits is used to buy PLLD on open markets, reducing circulating supply.

- Liquidity enhancement → Supporting smoother trading and stability.

- Staking rewards → Holders can lock PLLD for passive income.

- Governance rights → Active community participation in ecosystem decisions.

- Loyalty incentives → Long-term holders benefit from periodic airdrops and bonus rewards.

This dual-stream model—real estate NFTs for property income and PLLD tokens for arbitrage-driven rewards—ensures clarity, transparency, and diversified opportunities.

Roadmap

Phase 1 (0–6 Months)

- Expand arbitrage coverage to multiple exchanges

- Conduct buybacks from initial trading profits

- Complete preliminary audits

Phase 2 (6–12 Months)

- Launch PLLD Swap

- Roll out first fractional real estate NFTs

- Integrate advanced arbitrage (options, futures)

Phase 3 (12+ Months)

- Diversify global property portfolio

- Implement AI-based arbitrage modules

- Maintain ongoing buybacks and periodic vesting updates

The future of blockchain is not about speculation—it's about utility, sustainability, and integration with real-world assets. Palladium Network (PLLD) embodies this shift by converging tangible real estate with high-frequency arbitrage, creating a more stable, transparent, and rewarding ecosystem. For investors seeking real-world backing, consistent rewards, and exposure to premium properties, Palladium is more than just a project—it's a gateway to the next evolution of decentralized finance.

Whether you're a crypto investor, real estate enthusiast, or DeFi explorer, Palladium Network offers a unique opportunity to be part of a balanced, democratized digital economy.

Conclusion

The Palladium Network is building a more stable and adaptive investment ecosystem by combining asset diversification, risk management, transparency, innovation, flexibility, and decentralized governance. By balancing stability and adaptability, the Palladium Network provides a unique and engaging platform for investors of all experience levels. As the investment landscape continues to evolve, the Palladium Network is poised to play a leading role in shaping the future of the industry.

Stay connected with us:

- Website: https://plld.net/

- Twitter: https://x.com/DDTechGroup

- Telegram: https://t.me/Palladium_PLLD

- Whitepaper: https://plld.net/whitepaper

- View PLLD on CoinGecko: https://www.coingecko.com/en/coins/palladium-network

- Forum Username: AndrezIniesta

- Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3122356

Komentar

Posting Komentar